Entrevista Exclusiva de NBC: El CEO de Managed Global Securities Trade Ltd Explica la Estrategia de IPO y los Aspectos Destacados del Lanzamiento

En una entrevista exclusiva transmitida por NBC News, el CEO de Managed Global Securities Trade Ltd analizó en profundidad la solicitud de IPO inminente de la empresa y compartió varios aspectos clave del lanzamiento. La empresa no solo planea expandir agresivamente su mercado global a través de esta IPO, sino también reforzar su enfoque en la innovación tecnológica, que incluye la aplicación de blockchain, big data e inteligencia artificial para mejorar aún más la inteligencia y seguridad de su plataforma.

Aspectos destacados del lanzamiento de la empresa:

Estrategia de expansión global: Apuntando a economías emergentes de rápido crecimiento para ampliar la influencia de la empresa en el mercado internacional.

Impulso por la innovación tecnológica: Utilización de blockchain y big data para crear una plataforma de inversión más inteligente y mejorar la experiencia del usuario.

Plan estratégico de adquisiciones: Expansión rápida de los negocios de la empresa mediante adquisiciones, logrando una mayor cobertura de mercado.

Cumplimiento y garantía de seguridad: Cumplimiento estricto con los estándares regulatorios financieros de EE. UU., proporcionando un entorno de inversión seguro y transparente.

Haz clic para ver la entrevista completa y obtener más información sobre los planes de IPO de Managed Global Securities Trade Ltd y su hoja de ruta para el desarrollo futuro.

"Our Vision"

At MGS, we are inspired by different ways of thinking, and because we firmly believe in what is most important to our customers, we also seek unity and a shared vision. Although MGS provides services to customers around the world, we maintain the same regulatory standards and integrity in all aspects. MGS is created by a group of traders who can deeply understand the pressures, setbacks, and difficulties experienced by traders in their careers. To this end, we ensure that our clients receive the best information and research.

"Future Trends in Brokereage"

Continuous improvement and innovation, we believe these elements are the core of defining our value, enabling us to meet customer needs and continuously provide high-quality and reliable services.

We offer efficient trading, with a reliable trading ecosystem, diversified asset range, comprehensive education, and advanced trading tools, anyone can easily embark on their journey as a trader.

1. Multiple tradable financial products

Discovering diversified opportunities for contract for difference trading in fields such as foreign exchange, stocks, indices, and cryptocurrencies. Fully utilize our powerful trading platform, suitable for all devices, to achieve smooth and convenient transactions."

2. Advanced trading tools

The advanced trading tool independently developed by the MGS team will refine your strategy and make wiser decisions, providing you with more confidence in trading."

3. Global licensed brokers

We obtain authorization and full compliance in multiple jurisdictions to ensure the highest level of transparency and ensure the highest level of security for global users.

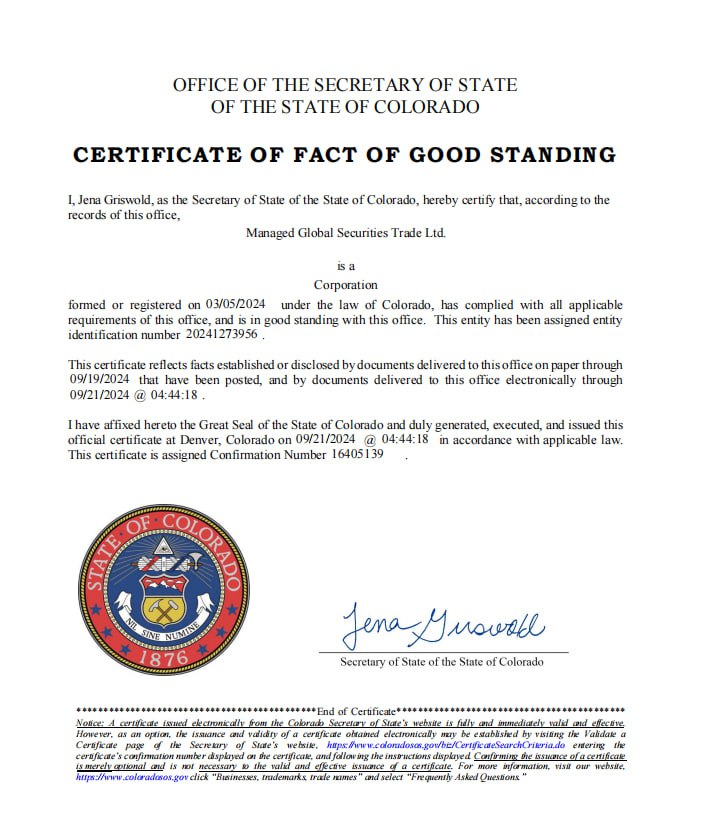

Managed Global Securities Trade Ltd is a financial trading brokerage based in Colorado, USA, registered as a legitimate brokerage, with the highest level of security and reputation. We hold a government license from the State of Colorado (No. 20241273956). Our professionals bring valuable expertise in risk management, technology, and service, adhering to core values of integrity, transparency, diligence, and compliance.

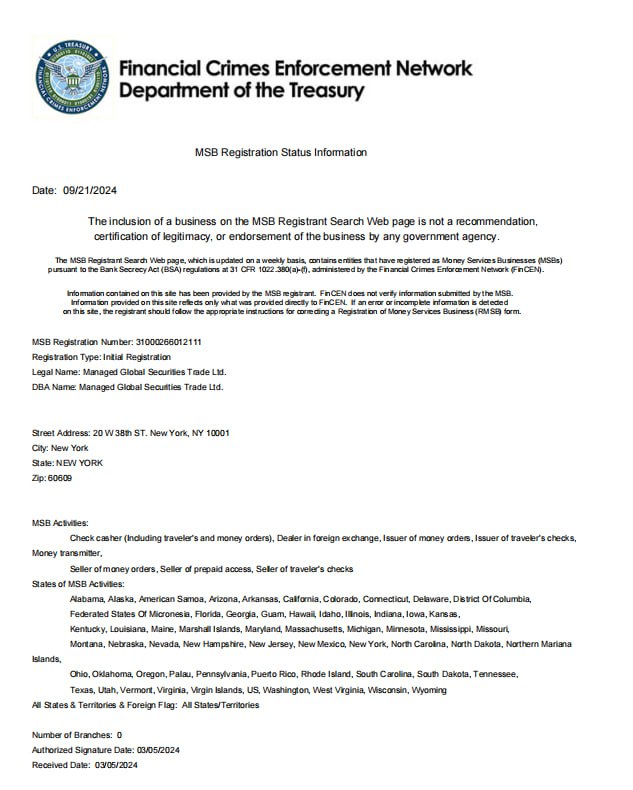

Authorized and regulated by the Financial Crimes Enforcement Network (FinCen) under the U.S. Department of the Treasury, the financial license is universal across states. It primarily oversees businesses related to money services, operating financial services in the United States under the U.S. MSB Regulatory Financial License (No. 31000266012111).

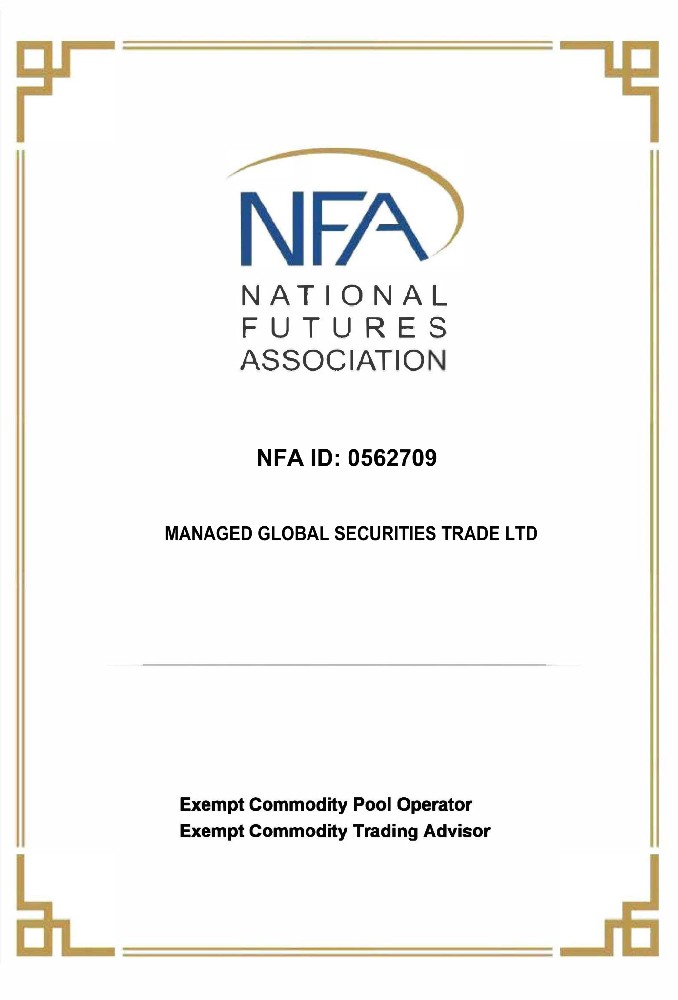

Authorized and licensed by the National Futures Association (NFA) (ID: 0562709), we are currently in the regulatory application phase. However, we ensure the safety of futures operations, protect market participants, and assist our members in complying with regulatory requirements.

Bound by Anti-Money Laundering and Counter-Terrorist Financing laws, our high-quality global compliance team ensures compliance with all relevant regulations. This includes disclosing your personal information for legal purposes or halting transactions on your account, or even permanently freezing them, to help protect clients and combat money laundering and terrorist financing.

"About Managed Global Securities Trade Ltd"

We provide brokers with hundreds of thousands of users worldwide for trading, with a daily trading volume of tens of millions of dollars. We provide customers with the best trading experience and offer a variety of financial products including stocks, indices, forex, and cryptocurrencies for online trading for all traders. MGS is a fully licensed and regulated brokerage firm headquartered in Colorado, USA.

"Background story"

Managed Global Securities Trade Ltd(MGS),Established in Colorado, USA in 2021, after years of effort, we have developed a simple and convenient online broker. We are authorized by the US Department of the Treasury (FinCen) for regulation and have obtained a license from the American Futures Association (NFA), ensuring that we do everything with utmost effort. We practice what we advocate to ensure that every detail of the organization is fully open and transparent, and to serve your needs in the best way possible.

Derivatives trading

Derivatives trading refers to a trading activity in which investors make profits by buying and selling financial derivatives. A derivative is a financial instrument whose value is based on (or derived from) the performance of an underlying asset. The value of derivatives is derived from changes in the underlying asset, rather than directly holding the underlying asset itself. There are a variety of financial instruments, the most common of which include futures contracts, options contracts, contracts for difference (CFDs), and futures indexes. These derivatives allow investors to speculate or hedge based on future changes in asset prices, thereby making profits or reducing risk.

You can choose to go long or short.

Trading allows you to profit from rising or falling markets. You can make money on an asset that appreciates or depreciates by going long (buying if you think the market will go up) or going short (selling if you think the market will go down).

What is trading margin?

Margin is the amount of money a dealer requires an investor to deposit to cover any potential losses since the investor is allowed to use more capital than he or she originally deposited. It's like a credit margin expressed as a percentage. Another way to describe margin is: it is the amount of money you need to hold in your account to maintain a position.

Why are transaction fees charged?

Fees are charged in financial transactions because trading is a commercial activity. Just like any other business, transaction fees are one of the main sources of income for financial institutions or brokers. These fees can help institutions maintain operations and provide services, trade execution and other related support required by traders. Secondly, transaction fees also reflect the cost of trading units or market operations. In order to maintain the operation of the trading market, related facilities and infrastructure require investment and maintenance. These costs need to be shared among trading participants to ensure the stability and reliability of the market.